SOL Price Prediction: Can SOL Hit $200 Amid Bullish Technicals and Market Optimism?

#SOL

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge as Price Trades Above Key Moving Averages

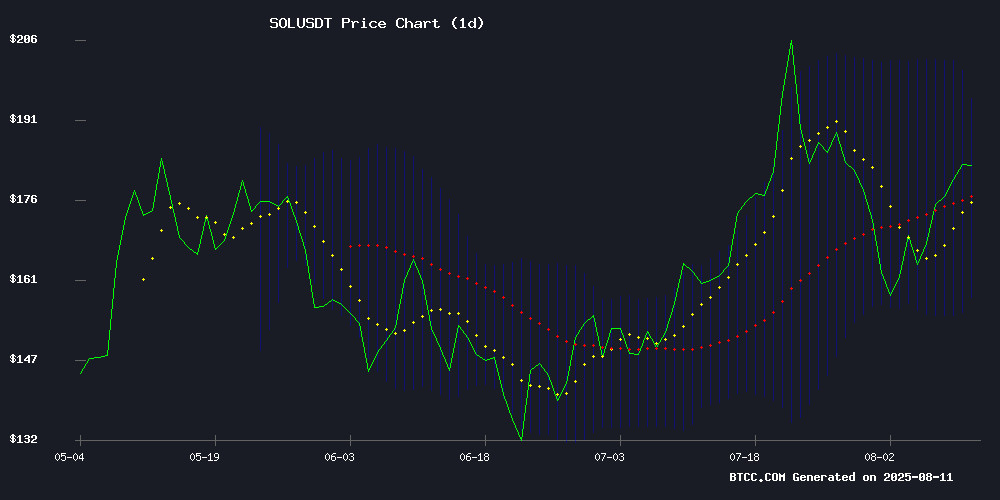

SOL is currently trading at $182.18, comfortably above its 20-day moving average of $176.45, indicating a bullish trend. The MACD shows positive momentum with the histogram at 3.5464, reinforcing the uptrend. Bollinger Bands suggest volatility, with the price NEAR the upper band at $194.89, signaling potential resistance. Analyst Mia from BTCC notes that maintaining above $176.45 could pave the way for further gains.

Market Sentiment Turns Bullish as Solana Breaks Key Resistance Levels

Recent headlines highlight Solana's strong performance, with predictions targeting $260 and even $300 following a breakout above $175. The $1.4B staking withdrawal has fueled buying pressure, while new Layer-1 blockchains leveraging Solana's technology add to the bullish narrative. However, risks like the LLJEFFY token crash remind investors of volatility. BTCC's Mia points out that the cup-and-handle breakout pattern could drive SOL toward $200 if momentum sustains.

Factors Influencing SOL’s Price

GMX Targets $20.23 as Volume Surges Over 2,000%

GMX has launched its first real-world asset perpetual contract, SPY/USD, marking a significant step in bridging decentralized and traditional finance. The contract tracks the S&P 500 ETF, leveraging Chainlink's price feeds for accuracy and Chaos Labs' risk parameters for stability.

Trading volume for GMX derivatives has skyrocketed, with open interest jumping 130.74%, reflecting strong market optimism. The platform's technical upgrade to version 0.7.0, including full Rust SDK support, aims to streamline developer integrations and expand third-party tools.

Price targets for GMX have been set at $20.23, supported by bullish momentum and rising derivatives activity. This move signals GMX's strategic push to diversify its product offerings and attract new users.

Solana Price Prediction: SOL Eyes $260 as Cup-and-Handle Breakout Setup Gains Strength

Solana is testing a critical resistance level at $185, with analysts eyeing a potential breakout toward $260. A multi-year cup-and-handle pattern suggests accumulating bullish momentum, echoing 2021's structural setup. The $185 zone has historically been a pivot point for major rallies.

Technical analyst Chris notes the pattern's symmetry and steady progression, indicating controlled buyer accumulation. A decisive close above $260 on high volume could confirm a macro uptrend. SOL has gained 18% weekly, with short-term traders now focused on the $185 battleground.

Solana Gains Traction Following Key Support Bounce Near $155

Solana shows renewed bullish momentum after rebounding from a critical support confluence around $155. The zone—where a long-term ascending trendline intersects the Fibonacci golden retracement area—has triggered accumulation from both retail and institutional investors.

Technical indicators suggest further upside potential. The Stochastic RSI's oversold reading coincides with price action reclaiming higher levels, a classic reversal signal. Market participants now eye the $206 resistance level as the next logical target.

On-chain data reveals whales are accumulating SOL positions through futures markets. This institutional interest, combined with retail FOMO, creates a potent bullish cocktail. The asset's ability to hold above the golden Fibonacci zone (0.618-0.7) reinforces its status as a market leader in this cycle.

Solana Breaks $175 Resistance, Bullish Setup Points Toward $300 Target

Solana (SOL) continues its upward trajectory, firmly holding above critical technical levels as investor interest surges amid a broadly stable yet bullish crypto market. The token has gained 11.94% over the past week, trading at $180.37 with a 24-hour volume spike of 13.55% to $6.56 billion. Market capitalization now stands at $97.29 billion, reinforcing SOL's position among top-performing assets this month.

Analyst WebTrend highlights SOL's breakout above $175 resistance, now flipped to support, with the weekly chart revealing higher lows—a bullish reversal signal after months of correction from late-2024 highs near $300. The setup suggests a $300 target, offering ~66% upside, contingent on holding $175 support. A decisive move above $200 could accelerate momentum.

Solana (SOL) Breaks $180 Barrier as $1.4B Staking Withdrawal Fuels Rally

Solana's SOL surged 17% this week to $181.31, defying expectations as a $1.4 billion staking withdrawal coincided with bullish momentum. The token now trades above all major moving averages, with its RSI at 57.12 suggesting room for further upside.

Market dynamics turned counterintuitive on August 9 when 8 million SOL tokens flooded the market—institutional and retail demand absorbed the supply shock with remarkable efficiency. This resilience underscores Solana's growing prominence in the digital asset space.

The ecosystem received an additional boost with the August 4 launch announcement of Solana's second-generation Android smartphone, though hardware developments typically exhibit delayed price impact. Technical indicators now point to sustained bullish conditions as SOL establishes new monthly highs.

Scaramucci Warns Trump's Crypto Ventures May Enable Corruption

Anthony Scaramucci, former White House Communications Director and SkyBridge Capital founder, raised concerns about potential corruption risks tied to Donald Trump's cryptocurrency ventures. Speaking at the Financial Times Digital Asset Summit, he highlighted the Trump family's involvement with SOL-based meme coins and partnerships like Crypto.com's Trump Media tie-up as distractions from bipartisan crypto consensus.

"Pathways for some level of corruption" exist despite giving the Trumps the benefit of doubt, Scaramucci cautioned. The remarks underscore growing scrutiny of political figures' crypto dealings as digital assets gain mainstream traction.

Solana's Technology Fuels New Layer-1 Blockchains Aiming to Outperform

Solana has solidified its position as the fastest and most cost-effective layer-1 blockchain, attracting developers to leverage its underlying technology for new blockchain ventures. Around two dozen Solana Virtual Machine (SVM) chains are in development, including layer-1s, layer-2s, and application-specific chains.

Among these, Fogo stands out as an upcoming layer-1 blockchain. It aims to maximize SVM performance by exclusively running the Firedancer validator client on a permissioned validator set with multi-local consensus. Fogo's strategy hinges on optimizing Solana's infrastructure to push scalability and efficiency further.

SOL Strategies Expands Solana Holdings with $20M Purchase

SOL Strategies, a Canadian publicly traded company dedicated to bolstering the Solana blockchain ecosystem, has acquired an additional $20 million worth of Solana (SOL). The purchase, finalized on May 6, represents the first tranche of a $500 million convertible note facility.

The company secured 122,524 SOL tokens at an average price of $148.96 per token, totaling approximately $18.25 million. "With the closing of our initial $20 million tranche from the ATW facility, we're executing exactly as promised – strategically acquiring SOL to expand our validator operations and ecosystem position," said Leah Wald, CEO of SOL Strategies.

Solana Token LLJEFFY Crashes 86.8% After Suspicious 'Legacoin' Promotion

A Solana-based token, LLJEFFY, surged 2,115% to a $105 million market cap amid rumors of Zerebro founder Jeffy Yu's suicide, fueled by a now-removed obituary. The token's rise was further amplified by a posthumous blog post promoting Yu's "Legacoin" project.

Doubts emerged when the obituary was taken down and local coroners found no record of Yu's death. The token collapsed 86.8% after investors discovered the deployer wallet remained active, buying tokens during the pump.

Solana Eyes $178 Breakout as Bullish Technical Patterns Signal Rally Potential

Solana's SOL token demonstrates robust bullish momentum after breaching key resistance levels, with technical indicators suggesting potential for further upside. The cryptocurrency has formed a classic ascending triangle pattern—a formation often preceding breakout rallies—while maintaining support above its long-term trendline.

Market participants are closely monitoring the $178 price level, which could act as a springboard for accelerated gains if decisively overcome. The asset's ability to sustain its uptrend despite broader market fluctuations underscores strong investor conviction.

Trading volumes and open interest derivatives data indicate growing institutional participation in SOL markets across major exchanges. The token's performance continues to outpace many large-cap alternatives, reinforcing its position as a market leader in the current cycle.

Hawk Tuah Meme Coin Scandal: Internet Personality Expresses Regret Amid $490M Crash

Haliey Welch, the viral 'Hawk Tuah Girl,' has publicly addressed her involvement in the Solana-based meme coin that collapsed 93% after reaching a $490 million market capitalization. The token's abrupt crash triggered a federal lawsuit alleging a rug pull scheme.

Welch admitted limited understanding of cryptocurrency during the controversy, stating she took a mental health hiatus following the fallout. 'I feel sorry for people who lost money,' she remarked, while supporting legal action against the project's creators.

The internet personality has since resumed her Talk Tuah podcast, vowing increased scrutiny of future business ventures. The incident underscores the volatile nature of meme coins on high-throughput blockchains like Solana, where speculative assets can rapidly gain and lose value.

Will SOL Price Hit 200?

SOL's technical and fundamental backdrop suggests a strong chance of reaching $200. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Price vs. 20MA | $182.18 > $176.45 | Bullish trend |

| MACD Histogram | +3.5464 | Growing momentum |

| Bollinger Band Position | Near upper band ($194.89) | Potential resistance ahead |

Mia from BTCC emphasizes that a close above $178 could accelerate the rally, but advises monitoring the $194.89 resistance level.

- Technical Strength: SOL trades above 20MA with bullish MACD crossover.

- Market Sentiment: News highlights breakouts and institutional interest (e.g., $20M SOL purchase).

- Risks: Volatility from meme coins and staking withdrawals requires caution.